A unique tax reference (UTR) is a 10-digit number issued by HMRC to companies and those who register for Self Assessment. As the name suggests, it is entirely unique to its owner and is a crucial piece of information to keep safe when forming a company.

This blog explains everything you need to know about a company’s unique tax reference, including why you need one and how to recover a UTR if you lose it.

Who needs to apply for a unique tax reference?

Anyone who files tax returns with HMRC requires a unique tax reference. This includes self-employed individuals who need to declare income through Self Assessment.

Company directors and shareholders require a unique tax reference if they receive untaxed income from a company, such as dividends or directors’ loans. These payments must be declared on a Self Assessment tax return, which you can’t do without a UTR.

When you register a company, the company itself will also need a UTR. It is sometimes referred to as a ‘tax reference’ or ‘Corporation Tax reference’. The UTR allows the company to register for Corporation Tax, file a Company Tax Return each year, and pay its tax bills.

Please note that when a unique tax reference is issued to individuals registering for Self Assessment, it is known as a personal UTR. This should not be confused with the company UTR.

The company UTR is also distinct from the company registration number (CRN) and VAT registration number. They serve very different purposes, so be careful not to mix these numbers up.

Where to find your company’s unique tax reference

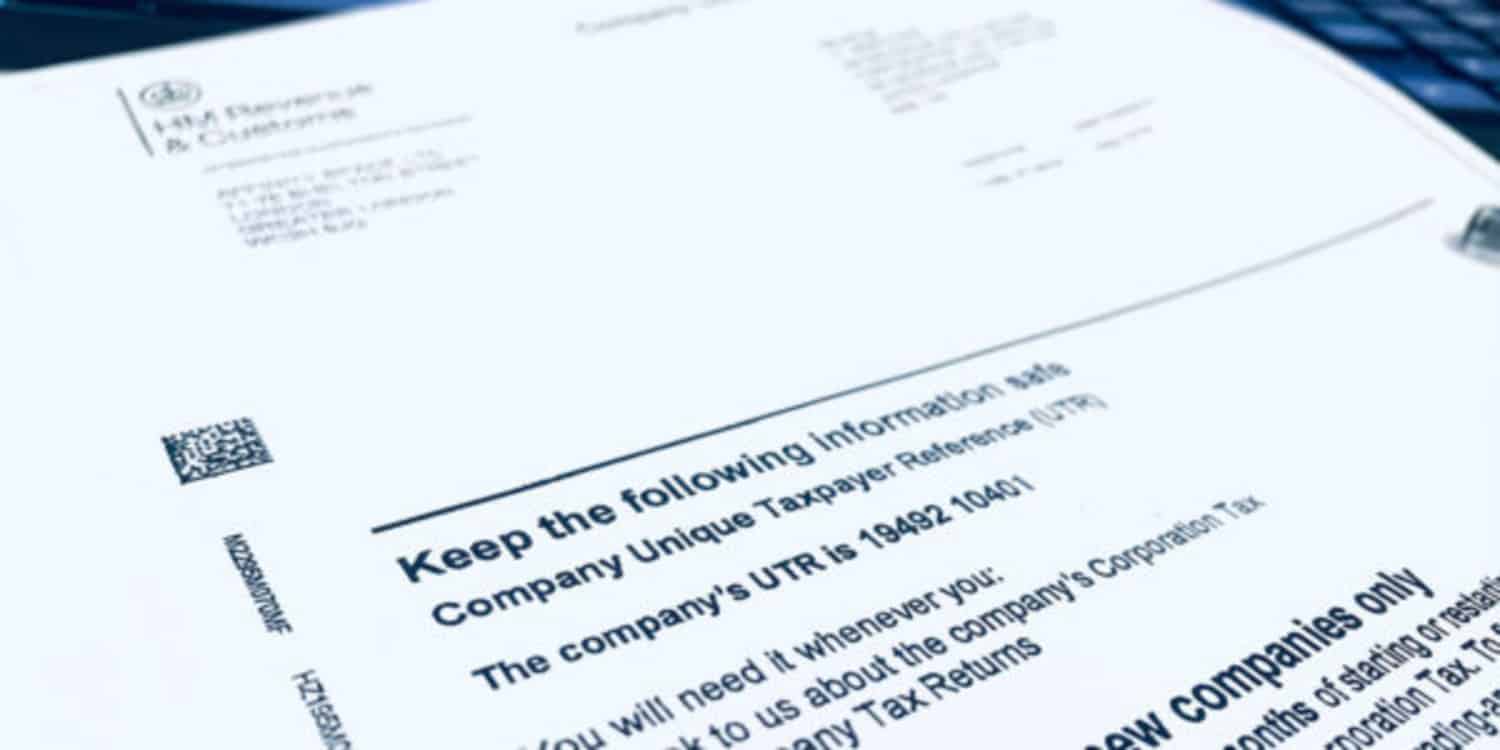

When you form a limited company, HMRC will receive notification from Companies House. Shortly thereafter, HMRC will automatically send a letter to your registered office address within 15 days (it takes longer if you live overseas). This letter will contain your company’s unique tax reference and essential guidance on your tax responsibilities.

The company’s UTR will be printed next to a heading like ‘Official Use’, ‘Tax reference’, or ‘UTR’ at the top of the first official letter from HMRC. You will also find it on most other forms of statutory communication from HMRC, including the Notice to Deliver a Company Tax Return.

Company information required by HMRC

You must register your company as ‘active’ for Corporation Tax purposes with HMRC within three months of carrying out any business activities or receiving any income. At this time, you should provide the following information to HMRC:

- Company name and registration number (CRN)

- Start date of trading activities (this will determine the start date of your first Corporation Tax accounting period)

- Principal address where business activities are carried out (this can be the registered office address)

- Principal business activities carried out by your company (you will require a SIC code for this)

- The date you will make your company’s annual accounts up to (this is known as the ‘accounting reference date’, or ARD, and it will likely fall on the anniversary of the last day of the month of company formation)

- Notification if you have taken over an existing business or are part of a group

- Details of all company directors

- Notification of appointing an agent (e.g. accountant or tax advisor) to deal with your company’s tax affairs, if applicable

Shortly after submitting this information, HMRC will send another letter to your registered office confirming the deadlines for paying Corporation Tax and delivering a Company Tax Return.

Generally, you should pay your Corporation Tax bill electronically within 9 months and 1 day from the end of each accounting period. You should submit your Company Tax Return online no later than 12 months after the end of each accounting period. Remember, you will need your UTR to complete these tasks.

Recovering a lost unique tax reference

It’s crucial to keep your company UTR safe and secure. However, as it’s delivered on paper, it’s not uncommon to misplace it, so don’t panic if this happens to you.

To find your UTR, check other HMRC documents the company has received in the past, such as notices to file a return or payment reminders. You can also view it in the HMRC app.

If you still can’t find it, you can request a copy via the HMRC website. To do this, you’ll need your company registration number and registered company name. HMRC will post a copy of your company’s UTR to your registered office address.

Keep in mind that if your company is recently incorporated, the UTR may still be on its way. If it doesn’t arrive within 15 working days, let HMRC know.

Can you share unique tax reference numbers?

Your company’s unique tax reference is strictly confidential. You shouldn’t share it with anyone unless they are authorised to act on the company’s behalf (e.g. an accountant filing a Company Tax Return). In this case, they’ll need the UTR.

Remember that this number grants access to important financial information about the company and allows people to carry out its tax processes. To avoid the risk of fraud, keep your company’s UTR safe and secure. If you need to share it with anyone, ensure they are authorised to act for the company.

Summary

Your company’s unique tax reference is one of the most important pieces of information you’ll receive after forming a company. It’s your responsibility to keep it safe and secure, as you won’t be able to fulfil your tax obligations without it.

We hope this article is helpful to you. If you have any questions about UTRs or any other topics we’ve discussed above, please leave us a comment below.

In the meantime, explore the Rapid Formations blog for other articles on company formation, business advice, and more.

Hello,

We have registred as Ltd. 5 months ago and have requested for register for HMRC more than a month ago.

They informed us that an activation code for the service will be sent by post once the application has been succsessfully verified and the enrolment is complete.

We believe they will sent the Employer Reference Number than also, but still waiting for.

How long does it take the activation code for the service and the Employer Reference Number be provided by HMRC to the Ltd.’s applicant ?

Thank you in advance,

Kind Regards !

Hi Ljubo,

Thanks for getting in touch.

You should have received your activation code and reference number by now. However, I’m afraid I cannot offer any assistance – only HMRC can deal with this issue. You can contact them on 0300 200 3600.

Best wishes,

Rachel Craig

It’s really odd they don’t just do this all automatically or give you a very clear document when you form a limited company of important dates and things you need to do. I got a booklet with so much stuff in I got confused and have learnt the hard way of finding out I should have been doing certain things.

Thankfully every time I have called HMRC they have been so helpful and polite. They genuinely want to help you so don’t be afraid to call for things like the UTR.

How long after forming a Limited company via Rapid formations should I be in receipt of the UTR?

Hi Natasha,

Have you had any correspondence from HMRC? If it has been more than 3 weeks since you formed your company, give HMRC a call on 0300 200 3410 to enquire about your UTR. We have no involvement in the issuing of these numbers.

I hope this helps,

Best wishes,

Rachel Craig

hi , i’m in U.K. from august 2015 , i came trough a agency an start working , for 6 months under that agency after that the company hired me , but i didn’t get any U.T.R. number …. what can i do now ?

Hi Andrie,

Did you form a UK limited company or do you work for an employer/agency?

Rachel

Hi. I am going to be sub contracting very soon. Can I register myself as a limited company and carry out work for other companies or do I have to be a sole trader? If I can be limited,do I have to inform them or can I just obtain work using just my name as I will be a director?

Hi Brad,

Yes, of course. It is very common for contractors and subcontractors to operate through a limited company rather than as a sole trader.

You will need a company name – your own given name may be suitable if this is how you wish to be known professionally, it’s up to you. You will have to notify clients that you are operating through a company – your company name, number and registered office details should be displayed on your website (if you have one) and all business paperwork, including emails. It’s just a formality.

You’ll probably find that limited status appeals to more people, so it’s a good move to make as a contractor.

Give me a shout if you have any more questions or need help setting up your company.

Best wishes,

Rachel

Is this the same process for Sole-trade start ups? I’ve filled in the online application form but have not received any acknowledgement or anything?

Hi,

It’s slightly different when registering as a sole trader. You should receive an activation code in the post within about 10 days of registering online. This will allow you to sign into your online account and obtain your unique taxpayer reference. If it’s been more than 10 days and you’ve not heard from HMR, call them on this number to find out what’s going on: 0300 200 3310. There’s no great rush to get this number though, so don’t worry too much about it just now.

All the best.

I have a company not traded and do not have UTR no how do I get for company

Hi you have to inform HMRC that your company is dormant and you are not obliged to file a CT return due to its dormancy otherwise you will get a penalty which you can always appeal it.

As to the company UTR, HMR&C automatically send it to the registered company address. You can call HMRC CT helpline on 03002003410 or visit HMRC website

Good luck

Hi, today I was in the bank. And have a problem with the account opening. I have NIN but they still need letter from it to proof my address. Bur I have my NIN maybe 6 years already, and I ave no idea where the letter is, and I just moved to UK 3 weeks ago agen. so the question is- WHERE I MUST TO CALL TO GET THE ( HMRC Tax Code (UTR) notification letter- must state National Insurance number too) Thats what the note says on the paper I got from the bank. THANKS FOR THE ANSWER

Dear Martin

Thank you for your message.

If you cannot find your UTR number you should contact HMRC on 0300 200 3310 and they will send out a confirmation by post to you. It can take up to 15 days to come out by post and just to confirm, HMRC will not give you the details by telephone.

If you have any correspondence from HMRC it would be worth checking if the UTR number is on it.

Kind Regards

I have been trying for the past 4 months to get a UTR number. I have phoned and been kept on the line for over 45 minutes each time. When I eventually got through 3 weeks ago, a lady took my details and said

to expect my UTR in the post either late that week or the following week. 3 weeks later I am still waiting.

I tried today again to phone, but no response, just kept on-line saying “we will be with you shortly”.

I am trying to run a business and need this number. Can some-one please tell me what to do. My local Tax office said they cannot help. Desperate……..Mark

Dear Mark

Thank you for your e-mail.

Unfortunately there is nothing we can do to help you with this. The only way to get your UTR number is to call 0300 200 3410 and wait until you can speak to someone and they should arrange for your UTR to be sent out to you

Kind Regards

Great post

I need a letter from HMRC confirming my company name and address and UTR.

But I cant find a number to call of a request form.

Dear Eamonn

Thank you for your message.

If you need to request a new UTR number then the HMRC number to call would be the Corporation Tax Helpline – 0300 200 3410.

Kind regards