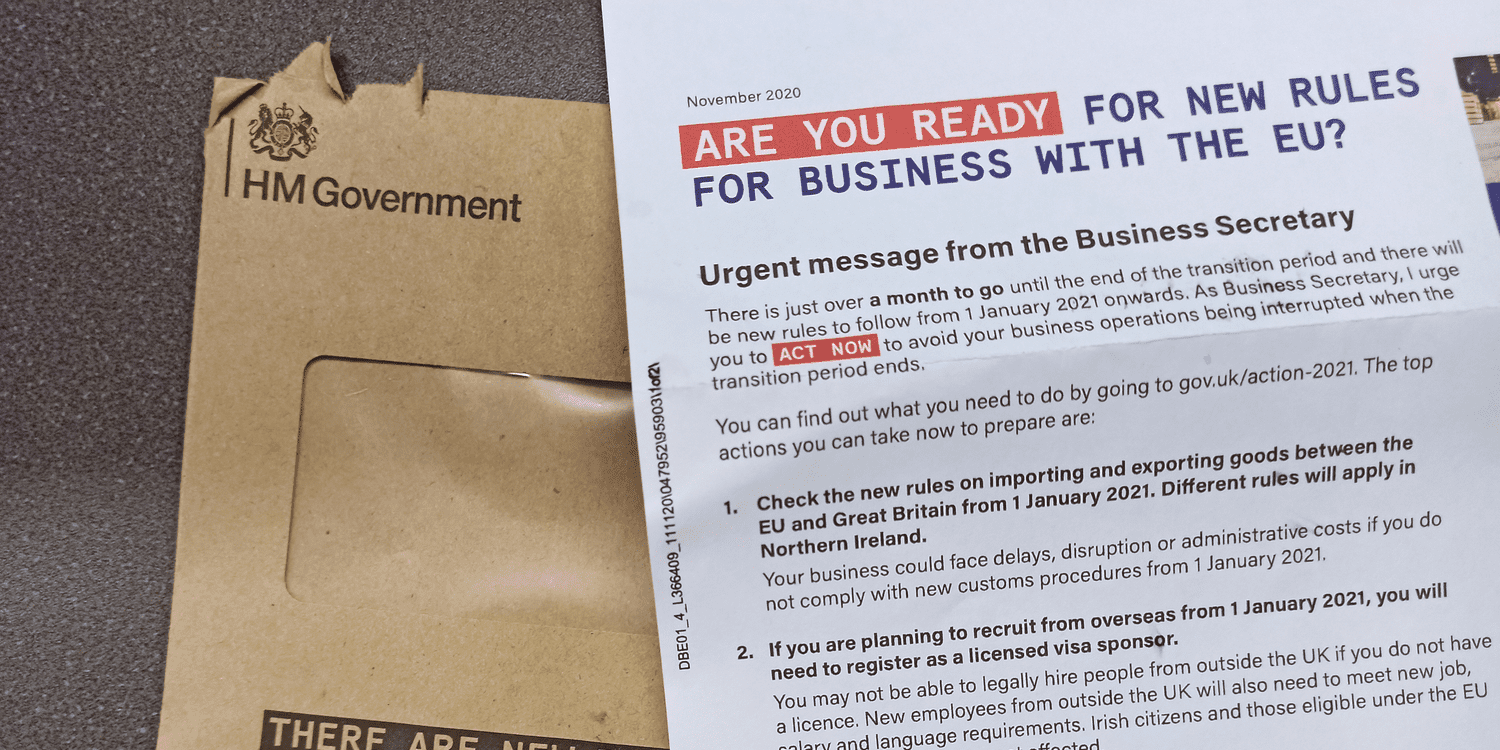

The end of the Brexit transition period on 31 December 2020 means that UK businesses are now obliged to comply with the new rules.

Although the majority of UK regulations have remained the same as before Brexit, companies should be aware of certain changes. We will consider some of the rule changes and what they mean to UK businesses.

Changes to existing companies and LLPs

SEs and EEIGs

There are two types of European entities, formed under EU law, which can no longer be registered in the UK following Brexit:

- Societas Europaea (SEs) – these are public companies registered in accordance with the corporate law of the European Union.

- European economic interest groupings (EEIGs) – these are a form of association between companies or other legal bodies, firms or individuals from different EU countries who need to operate together across national frontiers.

Any SEs previously registered in the UK were automatically converted to a UK Societas following the transition period.

Any EEIGs previously registered in the UK were automatically converted to a UK economic interest grouping (UKEIG) following the transition period.

EEA corporate officers in UK companies

UK companies or LLPs which have EEA corporate officers (i.e. corporate director, secretary or LLP member) must now file the following details with Companies House:

- name

- registered (or principal) office address

- legal form and its governing law

- register and registration number (if applicable)

Any UK companies or LLPs that employed an EEA corporate officer before 1 January 2021 are required to submit the relevant details before 1 April 2021.

There are no other changes to UK company registration or filing requirements as a result of Brexit.

For official information have a look at – how companies need to report new information to Companies House after Brexit.

Employees

EU Settlement Scheme

All employers should ensure that any of their eligible employees have applied for the EU Settlement Scheme.

Under this scheme, EU, EEA, and Swiss citizens can continue living in the UK after 30 June 2021. Their families can also apply for the scheme, along with family members of eligible persons of Northern Ireland.

The deadline for applications is 30 June 2021.

Use this link to apply to the EU Settlement Scheme

Right to work in the UK

Employers should check the details of a job applicant’s right to work in the UK, to find out which types of work they are allowed to do and how long they are allowed to work in the UK. This check can be carried out using the online government service. To use the service, the job applicant’s date of birth and right to work share code is required.

In the absence of a share code, employers can check the applicant’s original documents. Copies should be made of these documents.

For official information – check a job applicant’s right to work.

Sponsor licences

Employers now require a sponsor licence if they wish to hire skilled workers from anywhere outside the UK. This applies to hiring EU citizens (except Irish citizens) who were afforded freedom of movement before Brexit. Any EEA or Swiss citizens already employed in the UK can continue working for their employer.

The main ways in which non-UK citizens can be hired by UK employers are through the Skilled Worker route and via intra-company transfers.

Anyone being recruited through the Skilled Worker route needs to prove that:

- they have a job offer from a Home Office licensed sponsor;

- they speak English at the required level;

- the job offer is at the required skill level of RQF3 or above (i.e. equivalent to A level);

- they will be paid at least £25,600 or the ‘going rate’ for the job offer, whichever is higher.

Any workers being transferred from an overseas part of a business to the UK can apply for the Intra-Company Transfer route. They need to:

- be sponsored as an Intra-Company Transfer by a Home Office licensed sponsor;

- have 12 months’ experience working for a business overseas linked by ownership to the UK business they will work for;

- be undertaking a role at the required skill level of RQF6 or above (graduate-level equivalent);

- be paid at least £41,500 or the ‘going rate’ for the job, whichever is higher.

Employers can apply for a sponsor licence here.

Official information on recruiting people from outside the UK is available here.

In preparation for moving goods

Businesses that need to move goods between Great Britain (England, Wales and Scotland) and the EU will generally need an Economic Operators Registration and Identification number (EORI number).

Companies that only move goods between Northern Ireland and Ireland, or which only provide services, do not require an EORI number.

Applying for an EORI number

The following information is required when applying for an EORI number:

- VAT number and effective date of registration (for companies that are VAT registered)

- National Insurance number (for individuals or sole traders)

- Unique Taxpayer Reference (UTR)

- Business start date and Standard Industrial Classification (SIC) code

- Government Gateway user ID and password

Most EORI numbers begin with ‘GB’. This will be followed by the VAT registration number for VAT registered companies. A different type of EORI number – beginning with ‘XI’ – is required if goods are being moved from Northern Ireland to Great Britain or vice versa.

Applications for EORI numbers beginning with ‘GB’ will normally be processed instantaneously. But numbers beginning with ‘XI’ will take around 4 working days.

Find out more about EORI numbers and how to apply here.

Moving goods

Moving goods in and out of Northern Ireland

There have been no changes in how qualifying Northern Ireland goods move directly from Northern Ireland to Great Britain.

But from 1 January 2021, businesses need to make declarations and may need to pay any tariffs due when bringing goods into Northern Ireland from Great Britain or from outside the EU.

UK-based businesses sending goods from Northern Ireland, or bringing goods into Northern Ireland, can check what declarations may need to be made here.

Declarations are not needed for any goods moving between Northern Ireland and the EU.

For official information refer to – trading and moving goods in and out of Northern Ireland.

Simplified customs declarations

Certain businesses can make a simplified declaration before exporting their goods. This essentially means that fewer details will be required to be submitted for the first part of the declaration. Customs will still need to be provided with more information, but this can be sent later in a supplementary declaration, within 14 days of the goods departing the UK.

Subject to a few exceptions, simplified declarations cannot be made for goods:

- covered by the Common Agricultural Policy

- subject to export licensing

- subject to excise duty

- that require a full customs declaration

There are two types of simplified declaration:

- Simplified declaration procedure – basic details of the export are submitted to customs using the National Export System. The goods and declaration still need to be presented at a port or airport.

- Entry in the declarant’s records – goods must be directly exported from the UK but can be cleared by entering information in company records if they are on business premises and subject to certain exceptions.

To find out more refer to – who can apply for simplified customs and how to apply.

Check duties and customs procedures

Businesses can use a government service to find information about how to move goods from the UK to the rest of the world and to check:

- rules and restrictions

- tax and duty rates

- what exporting documents you need

For official information refer to – check duties and customs procedures for exporting good.

Get help dealing with customs

Businesses can get help to deal with their customs issues from a range of intermediaries:

- Freight forwarders – they can move goods around the world for importers. A freight forwarder will arrange clearing goods through customs. They have the right software to communicate with HMRC’s systems.

- Customs agents or brokers – they make sure goods clear through customs.

- Fast parcel operators – they transport documents, parcels and freight across the world according to specific deadlines. They can deal with customs for a business as part of their delivery service.

Following Brexit, all of the above intermediaries must have been established in the UK.

The intermediary can act as a director or indirect representative. But they cannot act on the behalf of a business without written instructions which show whether they are acting directly or indirectly.

HMRC has a list of customs agents and fast parcel operators.

Intermediaries acting directly

Businesses can hire an intermediary to act directly in the name of their business. The business will be solely liable for:

- keeping records

- the accuracy of any information provided on your customs declarations

- any Customs Duty or import VAT due

But if the business gives clear instructions and the intermediary makes a deliberate or unreasonable error, the intermediary may become jointly and severally liable.

Following Brexit, an indirect agent can make customs declarations using the simplified declaration procedures, as long as they have their own authorisation.

Intermediaries acting indirectly

Businesses can hire an intermediary to act indirectly. In this scenario, the intermediary will not be acting in the business name but in their own name. An intermediary acting indirectly will be:

- equally responsible for making sure the information is accurate

- jointly and severally liable for any Customs Duty or import VAT

If they have authorisation, an indirect agent can make customs declarations using the simplified declaration procedures.

Businesses cannot ask an agent to act indirectly if they are declaring goods for:

- inward processing

- outward processing

- temporary admission

- end-use relief

- private customs warehousing

For official guidance have a look at – using customs agents and intermediaries.

Licences for moving goods

A whole range of licences is required for moving specific types of goods. A few useful links to government sources of information on licencing are contained below:

- Live animals and animal products

- Plants and plant products

- Drugs and medicine

- Medical devices

- Chemicals

- Art, antiques and cultural goods

- Waste

I hope you found this blog of interest. If you have any questions, please leave them in the comments section below and I will get straight back to you.