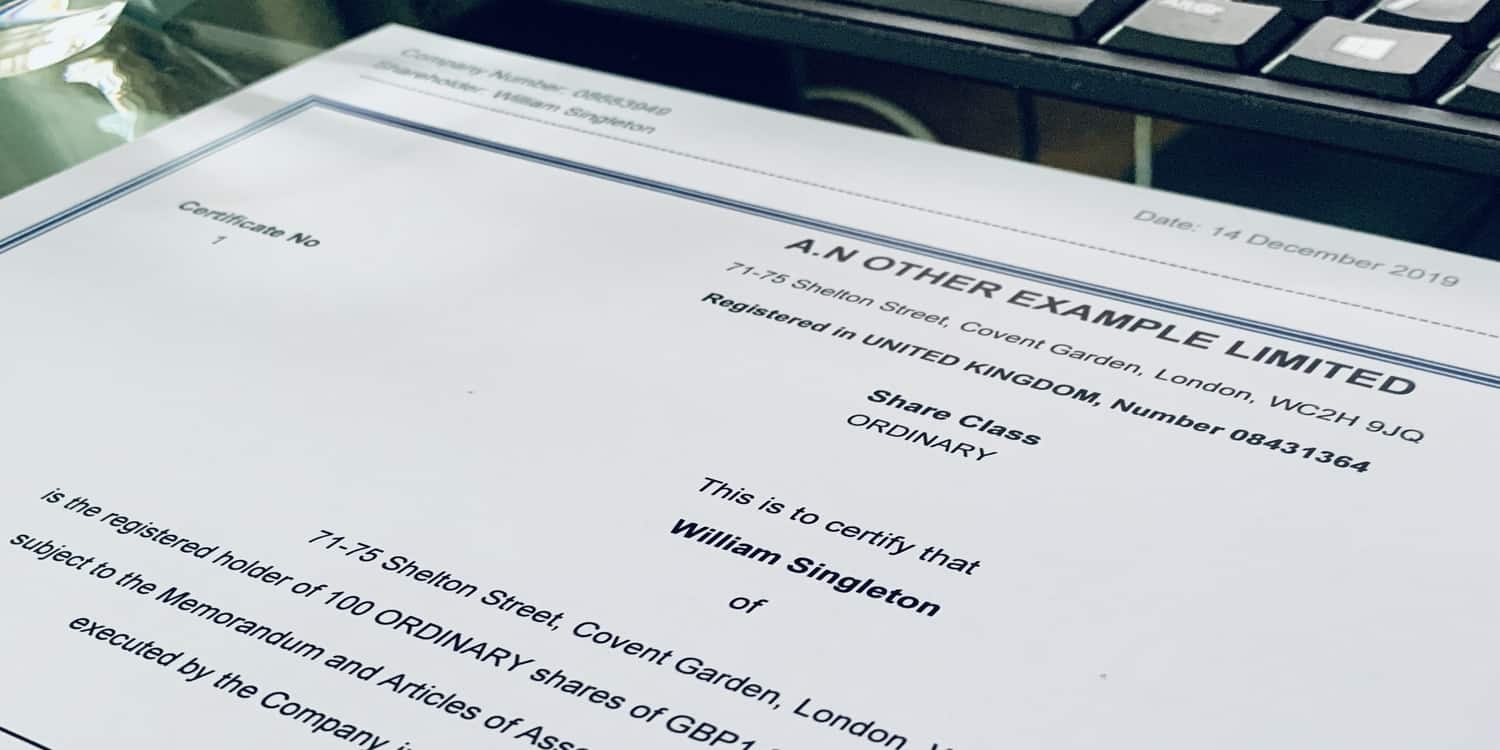

A share certificate is a document that a limited by shares company creates and distributed to its shareholders, the purpose of which is to prove ownership of shares in the company. Essentially, it is receipt of ownership, typically in the form of a single piece of paper or digital document.

Free Share Certificate Template

Limited companies issue share certificates to their shareholders when they purchase or receive gifted shares at any point after company formation. The share certificate confirms ownership of a share (or shares) from the date of purchase or transfer.

A share certificate provides independent evidence of title to shares, as per s. 768 Companies Act 2006. It enables its holder, known as a shareholder, to sell or transfer the share(s) to a new owner.

When are share certificates needed?

A share certificate should generally be issued within two months of the share(s) being allotted, i.e., no later than two months after the shares have been purchased or transferred.

According to section 24(1) of the model articles for private companies limited by shares ‘a company must issue each shareholder, free of charge, with one or more share certificates in respect of the shares which that shareholder holds.’

Share certificates are normally required whenever company shares are transferred or sold. The person selling or transferring their shares is required to return their existing certificate to the company which will cancel this and issue a new certificate to the new owner.

Another circumstance in which share certificates may need to be provided is that of share restructure. If a company needs to restructure its share capital, existing share certificates may need to be returned and amended or replaced with new ones which reflect the new structure.

It may be necessary to change the share capital of a limited company by:

- Issuing new shares – allotting new shares has the effect of increasing a company’s share capital.

- Reducing the share capital – the number of shares in the company will decrease by the reduction amount.

- Sub-dividing or consolidating the share capital – in this case, the company can change the number of shares and their nominal value, without changing the overall amount of share capital.

- Re-denomination of shares – this is the conversion of company shares from having a fixed nominal value in one currency to having a fixed nominal value in another currency.

- Reconversion of stocks into shares – if a company has previously converted shares to stock, it can reverse this.

For more information about changing the share capital of a limited company see our separate blog Share capital – how you can change it.

If a shareholder changes their name through marriage or deed poll, they may request a replacement share certificate which reflects their new name. We will consider this further below.

Recording original shareholders (subscribers) shares

The Companies Act 2006 prescribes that a company must issue a share certificate when any shares are allotted (issued).

It is common practice to issue share certificates to the subscribers (original shareholders) who set up the business and become members during the company formation process; however, there is no legal requirement to do so. This is because their details are recorded in the statement of capital and the memorandum of association.

What details must be included on a share certificate?

There are certain details which must be included on every share certificate. Section 24 of the model articles for private companies limited by shares specifies the information which should be included on each share certificate.

Number and class of shares issued

The number of company shares which are owned by the bearer of the share certificate and defines the class of shares. Examples of class of shares include ordinary shares, non-voting shares, preference shares, deferred shares, etc.

The nominal value of shares issued

The nominal value of shares is the minimum price at which they can be issued, for example 1p or £1, etc. Shares can never be allotted for less than this nominal value..

Share certificates must (a) have affixed to them the company’s common seal, or (b) be otherwise executed in accordance with the Companies Acts

Traditionally companies had their own unique corporate seals, which originally used melted wax.

Some companies still use modern versions of seals to execute official company documents. But under section 44(2) of the Companies Act 2006, an alternative to a seal for validly executing documents is a signature on behalf of the company ‘by two authorised signatories, or … by a director of the company in the presence of a witness who attests the signature.’

So it is no longer necessary to affix a company seal to a share certificate.

Other types of information which needs to be included on share certificates

- Share certificate number

- Name and registered number of the company

- Registered office address of the company

- Name of the shareholder/s

- Address of shareholder – in the case of joint shareholders, the address of the first named shareholder

- Date of issue of the share certificate

Can a single share certificate be issued in respect of shares of more than one class?

According to section 24 of the model articles ‘no certificate may be issued in respect of shares of more than one class.’

If the shareholder owns more than one class of shares, a separate share certificate must be issued in respect of each different class.

How are share certificates issued to joint shareholders?

Section 24 of the model articles states ‘if more than one person holds a share, only one certificate may be issued in respect of it.’

In the case of joint shareholders, all names can be included on one share certificate, with the address of the first named shareholder.

Safekeeping of share certificates

Banks and lenders may ask to see these certificates when you open a business bank account or apply for a loan. For this reason, you should ensure their safekeeping at all times. Consider storing copies of share certificates at your registered office or SAIL address with your company’s statutory records and registers.

Rapid Formations provides digital copies of share certificates as part of the company formation process. A PDF version of each one will be sent to you on the day of incorporation, so you can save them to your computer and print them at any time, or store them in the cloud.

How does a company deal with lost share certificates?

Digital copies of a share certificate can be lost if the shareholder loses access to their computer or cloud storage (e.g., as a result of a lost password).

Meanwhile, physical copies can be misplaced, thrown away by accident, or damaged in a fire. If a share certificate is lost or damaged, it will be necessary to issue a replacement.

The general procedure for dealing with requests to replace lost share certificates is as follows:

- Establish that the request is genuine, e.g., verify the identity of the person making the request to ensure they are the shareholder.

- Obtain any required evidence, administration fee and indemnity. The indemnity essentially covers the company in case of any liability incurred as a consequence of issuing a replacement certificate. It may also be necessary to obtain a guarantee by a third party (see below).

- Record the loss of the share certificate and the subsequent approval at a director’s meeting of issuing a replacement share certificate.

- Issue a new share certificate and send it to the shareholder.

- If the replacement share certificate has a new number, the register of members should be updated to reflect this change.

Third party indemnity guarantees

Before issuing a replacement share certificate, companies will normally seek an indemnity from the shareholder. This is an agreement under which the shareholder is obligated to cover any losses incurred by the company in connection with the replacement of the certificate.

In certain cases, the company may request that a third party, such as a bank or insurance company, provides a guarantee in respect of the indemnity. In effect, the third party will countersign the indemnity provided by the shareholder, and they will be ultimately responsible for ensuring that any losses sustained as a result of the replacement certificate being issued are recovered.

Is a new share certificate required for a change of name or address?

In the event that a shareholder officially changes their name by marriage or deed poll, it will be necessary to issue them with a replacement share certificate to take into account their change of name. It is vital that evidence of the name change is obtained before issuing a replacement share certificate.

If a shareholder just changes their address, there is no requirement to issue a replacement share certificate.

Do I need to provide copies of share certificates to Companies House?

There is no need to provide Companies House with copies of share certificates. However, a copy of each share certificate should be stored securely by the company.

Excellent discussion , I Appreciate the specifics . Does anyone know if my business can find a fillable MI PC559 version to fill in ?

Say I pay 10,000 for 10 shares. The share certificate says I am registered holder of 10 ordinary shares of £1. Is this correct?

Hi Stephen – Yes, that’s correct. The share certificate will state the quantity and nominal value of your shareholdings. The price you paid for them is irrelevant for the certificate.

Best wishes,

Rachel