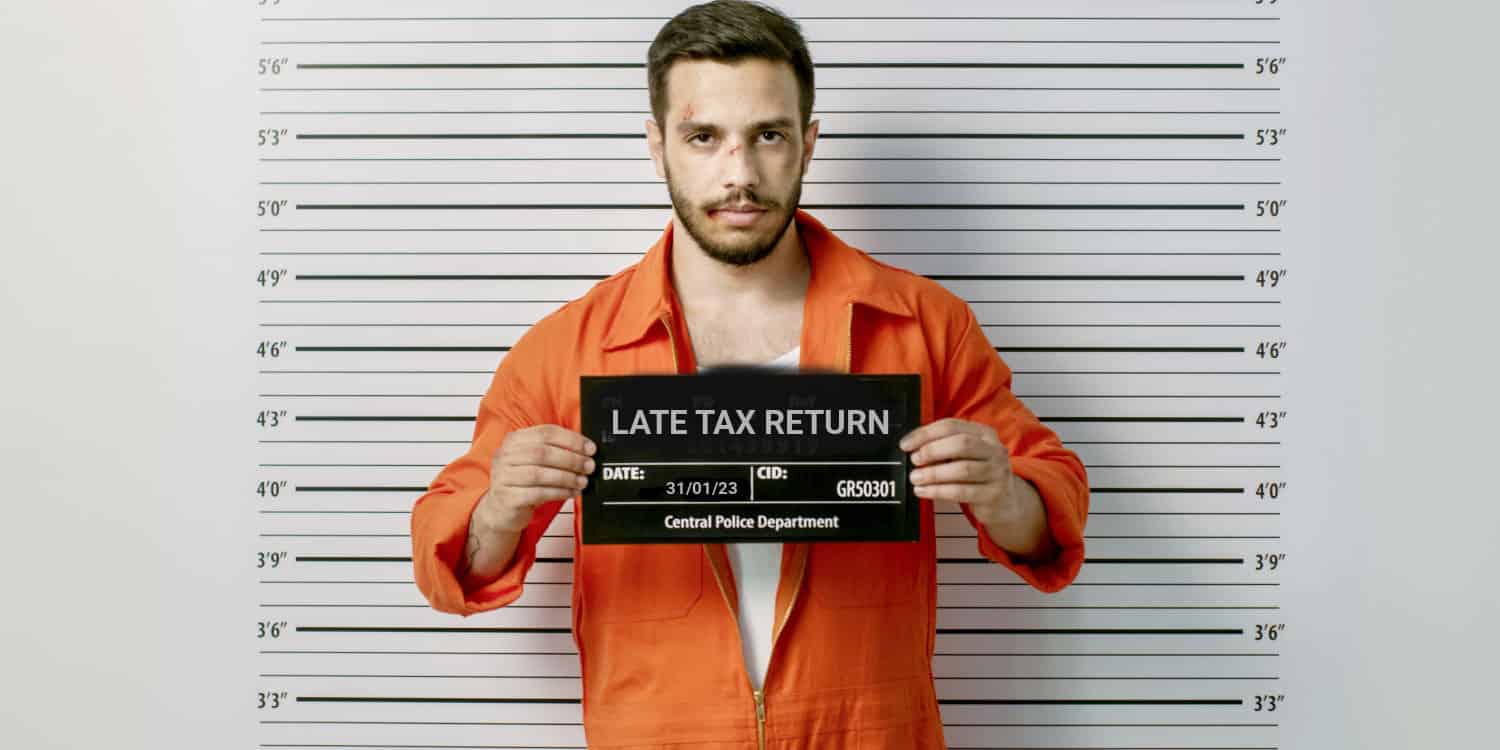

With the 31st January online Self Assessment deadline fast approaching, experts are predicting that HMRC is to be less lenient when it comes to waiving penalties associated with late filing. Previously, due to the pandemic, HMRC showed a level of tolerance, however, this attitude is apparently set to be dropped.

This will no doubt be a concern to the 5.7 million taxpayers who, according to HMRC, still haven’t taken care of their tax return.

However, it’s important to stress that HMRC will, as usual, allow you to appeal a late filing penalty if you have a ‘reasonable excuse’.

What are the penalties for late filing of Self Assessment tax returns?

If you can file within 3 months of the deadline passing, the penalty will be a fixed fee of £100, but if you let 3 months pass, the penalty will begin to grow:

- £100 for missing the filing deadline

- After 3 months – there is an additional daily penalty of £10 going up to 90 days (capped at £900)

- After 6 months – there is an additional penalty of 5% of the tax due or £300 (whichever is greater)

- After 12 months – another 5% or £300 will be added

What’s more, there are even further penalties for late payment of tax.

We recommend looking at the GOV.UK dedicated penalty page for more information on these fees.

Why this change of tack from HMRC?

In 2021 and 2022, HMRC waived late filing and payment penalties for one month after the 31st January deadline, giving people a little extra breathing room. But this courtesy is not expected to be extended to 2023.

According to Dawn Register, Head of Tax Dispute Resolution at accountancy firm BDO, the reason for this is to do with added pressure on HMRC:

“During the pandemic, HMRC did show some forbearance. Taxpayers were allowed to defer Self-Assessment and VAT payments, there was a moratorium on creditor-led insolvency action and HMRC temporarily suspended proactive debt collection activity.”

“The result was that tax debt ballooned. While the Revenue has worked hard to reduce this, the latest figures show total tax debt currently stands at £46.9bn. That’s more than double the pre-pandemic level at the end of March 2020 when tax debt was £19bn. As a result of this huge increase, HMRC’s Debt Management teams will be under considerable pressure to bring in the cash.”

HMRC’s bolstered tax collection powers

Not only are HMRC expected to be getting tough on penalties, but they’re also stamping down on retrieving debts, with BDO highlighting the extra steps that HMRC is taking to recover cash from people who have fallen into arrears:

“HMRC’s debt collection powers have expanded over recent years. It can recover some debts directly from bank accounts, ask for security for tax debts, use bailiffs, and, in some cases, seek to transfer a company’s liabilities to its directors.”

“The tax authority has also recently announced that its officers will take card readers with them when they visit taxpayers’ premises or homes to pursue tax debts.”

Haines Watts, our accounting partners

Whilst we are unable to offer tax services, we do have a partnership in place with Haines Watts – who provides chartered accountancy services.

If you formed your company with Rapid Formations, you can take advantage of our free ‘Introduction to an Accountant’ service whereby you can talk about your tax needs with a member of the Haines Watts team.

To claim your free consultation:

- Log in to your Rapid Formations Online Client Portal

- Select ‘My Companies’

- Click on the ‘View’ button next to your company name

- Select the ‘Shop’ tab

- Locate the ‘Company Services’ section and click ‘Add’ next to ‘Introduction to an Accountant’ service

- Select ‘View Cart’

- Review your order, agree to the terms and conditions, and select ‘Submit’

Haines Watts will then be in touch within 48 hours.

Or did you take care of your tax returns over the festive period?

In cheerier news, and what is now becoming a seasonable tradition, HMRC has released the figures for how many people used the festive break to tick their Self Assessment tax return off the to-do list. Here are the numbers:

- 25,043 tax returns were filed on 31 December

- 129 tax returns were filed on 1 January specifically between 00:00 and 00:59

- 17,571 tax returns were filed as a whole on 1 January

Are you one of the people who got in the festive mood by submitting their return as Big Ben rang out? Let us know with a comment!

Thanks for reading

If you haven’t taken care of your return yet, don’t panic.

Myrtle Lloyd, Director General for Customers Services at HMRC advises:

“My message to those yet to start is: don’t delay, do it online. HMRC provides lots of useful information to help you get started. Visit GOV.UK and search ‘Self Assessment’” – which we’ve done for you via the below link:

GOV.UK’s Self Assessment advice

We hope you have found this post helpful. For more posts like this, take a look at our central blog page.